As soon as buyers have found your own home, offers will ideally start off rolling in. (Keep in mind, though, that with home finance loan fees at the moment high, the number of purchasers who will still manage to obtain may be scaled-down than you’d like.) This is where a real estate property agent is your very best advocate and go-to supply for assistance. If your neighborhood market place favors sellers, consumers will probable supply close to asking price, or potentially even higher than. Conversely, if income are gradual in your area, you may have to be open up to negotiating.

“On numerous situations, we noticed fictitious regular wage payments manufactured to applicants’ lender accounts”, one detective said. “Something to provide the home loan lender the illusion that the customer experienced a nicely-paid work.”

Specified the continuing Dutch housing crisis, you will likely receive a large amount of features at the time your house is that you can buy. The truth is, your entire procedure could be a really speedy a single. In 2024, enough time amongst Placing a house up available and selling it can be as small as just two months.

For instance, geography could possibly affect how long your house lingers in the marketplace or how substantial of a listing price tag you will get absent with. In places wherever Competitiveness is scorching and stock is very low, odds have you been’ll sell speedier and command a higher price tag. Conversely, in sites where by house sales have cooled, you will likely have to operate harder to entice the appropriate consumer. The property market has shifted drastically Considering that the frenzied heights with the pandemic. Right now, superior rates are combining with substantial fascination costs to make significant affordability challenges: The median price tag for a house is in excess of $400,000, and mortgage loan rates strike a 22-year high in 2023.

Could it be permitted to change the procedure of negotiation if you are negotiating? That is also permitted. When there are lots of bids approaching or bidding the asking cost, it is hard to get a seller to determine who will be regarded the top consumer.

You may also try out HomeLight’s cost-free Internet Proceeds Calculator to estimate the price of selling your property as well as the Web proceeds you could earn through the sale.

Even hardened detectives are sometimes amazed by whatever they discover. 1 recent example was a schedule investigation to recognize a network of hiding destinations for copyright that in its place stumbled upon an enormous mortgages rip-off at the center from the nation’s best assets market place: Amsterdam.

When selling after a single year, the seller could maybe split even should they’re in a fast-increasing market place that has viewed potent appreciation. “In the majority of conditions, they’ll likely drop income when selling within the a single-year mark,” Liu states.

Your requirements will factor in, way too. For those who’re relocating for any task that starts off subsequent month in Yet another state, enough time to sell is obviously at the earliest opportunity. Or, should you’re house hunting, some time to sell could possibly be to-be-determined based upon whenever you’re in the process of buying.

Lastly, selling your house soon may also lower the perception of your residence between possible buyers: What’s Improper With all the place, They might speculate, that Extra resources these individuals are decamping so swiftly?

If you sell your house and create a gain, you're subject matter to cash gains taxes. To determine your income, subtract the initial acquire cost directory with the new sale price tag. This revenue is the quantity that The federal government may well impose taxes on.

Your property agent or perhaps the closing agent should offer you a whole list of fees you’ll be answerable for on the closing desk. The good news is the fact that you might not owe the IRS taxes on your own gains from your sale. It relies on whether or not it was your Most important residence, just how long you lived there and exactly how much you make around the sale. In case you’ve owned and lived in your home for a minimum of two out in the preceding five years just before selling it, then you will not need to fork out taxes on any earnings up to $250,000. For married couples, the amount you'll be able to exclude from taxes will increase to $500,000. In case your take advantage of the home sale is greater than that, while, you’ll should report it into the IRS like a money attain. eight. Contemplate using the services of a property lawyer

Our community professional about content Amsterdam Amsterdam Centre is the heart of the city and contains the popular canal belt. The canal belt is actually a UNESCO Entire world Heritage Website and consists of quite a few historic canals with monumental buildings and bridges. It is among the most well-liked vacationer sights in Amsterdam and provides a large amount to discover and do. And that is not the only thing that makes the middle of Amsterdam so stunning.

You never ever understand what Pal of a pal or distant relative may be wanting to buy. Make use of your Trulia listing connection to produce your property sale information and images simple to share.

Rick Moranis Then & Now!

Rick Moranis Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Judge Reinhold Then & Now!

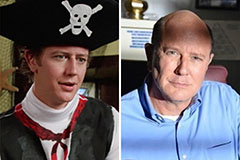

Judge Reinhold Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now!